If you’ve ever come across the term ‘crypto asset’ before, the chances are your mind went straight to Bitcoin.

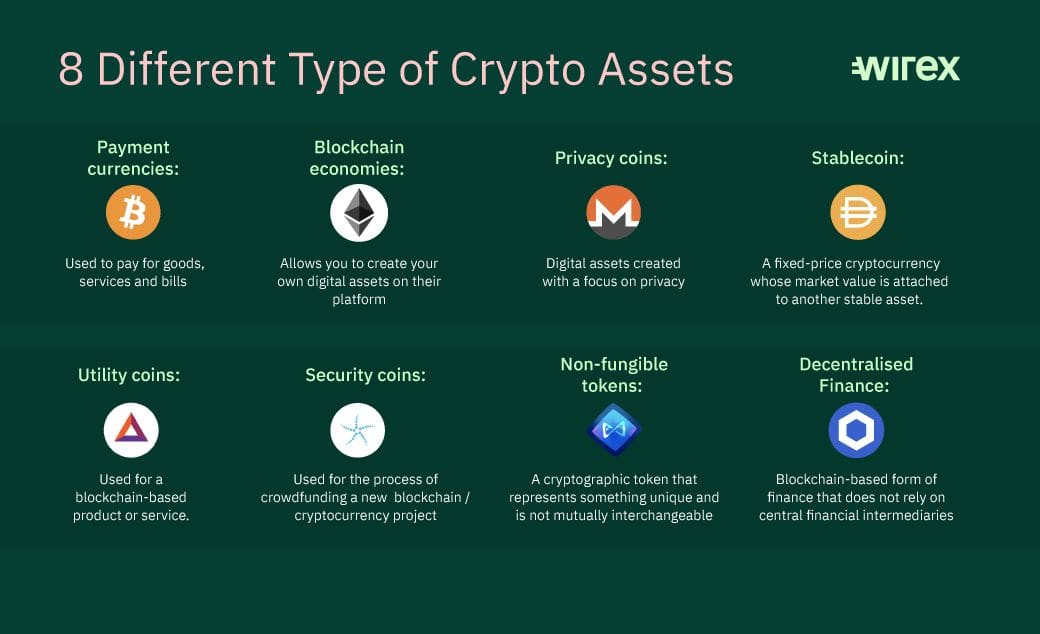

A crypto asset is a cryptographically secured digital representation of value. But did you know that there are 8 different types of them?

Let’s look into them in a bit more detail and find out where Bitcoin fits in.

Type 1: payment currencies

Payment currencies such as Bitcoin (BTC) and Litecoin (LTC) are used to make payments (surprise surprise). They utilise blockchain technology to encrypt, regulate and verify the transfer of funds between parties.

While most crypto can technically be used to pay for things, payment currencies can be used to buy goods and services with a much wider range of merchants.

Type 2: blockchain economies

Next up are blockchain economies. These are essentially platforms that take the functionality of blockchain technology further than just payments.

Ethereum and Cardano are good examples of blockchain economies. While Ethereum allows the creation of decentralised tokens and apps, Cardano builds on this idea, with the aim of being a more scalable, sustainable and interoperable platform.

Type 3: privacy coins

Let’s move on to privacy coins. This type of crypto asset has extra layers of encryption to keep transactional information secret.

Unlike Bitcoin, privacy coin owners are anonymous, their wallet address balance is private, and the amount sent or received in a transaction is known only by the sender and receiver.

Monero (XMR) and Dash (DASH) are examples of privacy coins.

Type 4: utility tokens

Utility tokens are designed to be used for a designated purpose within a blockchain economy. Most utility tokens are ERC-20 tokens like Basic Attention Token (BAT) and 0x (ZRX), which run on the Ethereum network. BAT, for example, was created to improve the effectiveness of digital advertising through its blockchain-based advertising system, the Brave browser.

A crypto asset is deemed a utility token if it does not qualify according to the Howey test, which determines whether a transaction is an investment contract.

Types 5: stablecoins

Popular with traders for their stable price, stablecoins are pegged to another asset class in order to reduce volatility. Dai (DAI) and Tether (USDT) are two you might have heard of, both of which are tied to the US dollar. Different stablecoins, however, use different methods to maintain a stable value.

Type 6: security tokens

Security tokens are crypto assets that pass the above-mentioned Howey test. They represent a stake in a blockchain project and often come with a reasonable expectation of profit in the future.

The first ever security token was Blockchain Capital (BCAP), which launched in April 2017 along with the world’s first tokenised investment fund.

Type 7: non-fungible tokens

Next, we have non-fungible tokens (aka NFTs or crypto collectibles), whose value is determined by rarity. The first NFTs to be minted using Ethereum’s ERC-721 standard were CryptoKitties – cute, colourful cats for virtually collecting and breeding that came about in 2017. Their initial popularity famously congested the Ethereum network.

Today, NFTs come in all shapes and sizes, ranging from Tweets to perfume.

Type 8: decentralised finance

Lastly, there’s DeFi. The DeFi movement aims to make decentralised financial services accessible to anyone with an internet connection and uses smart contracts to provide them. The most used DeFi platform is the Ethereum network, which enables the decentralised exchange of tokens, lending and borrowing, as well as staking, yield farming and a multitude of other ways to earn passive income. You can learn more about DeFi and its applications here.

Chainlink (LINK) and Compound (COMP) are two well-known DeFi tokens powering their respective blockchain platforms – Chainlink is an oracle network that connects blockchains with real-world data, whereas Compound is a protocol that lets you lend and borrow crypto.