DeFiZap is a dApp that jointly uses other DeFi protocols in order to simplify the use, in terms of time, clicks and also transaction costs.

DeFiZap allows combining the features of most of Ethereum’s DeFi platforms: Uniswap, Maker, Compound, BzX, Kyber Network, Synthetix, Fulcrum and Set. Currently, the dApp is still in beta and its development can be funded on Gitcoin.

When opening DeFiZap users are faced with a kind of questionnaire that asks what kind of investor they identify with, what level of experience they have with DeFi products, what strategy they want to adopt and if they have a bullish or bearish vision regarding Ethereum for the coming months. At this point, the user is directed to one of the Zaps, i.e. one of the recipes ready to be used with a click.

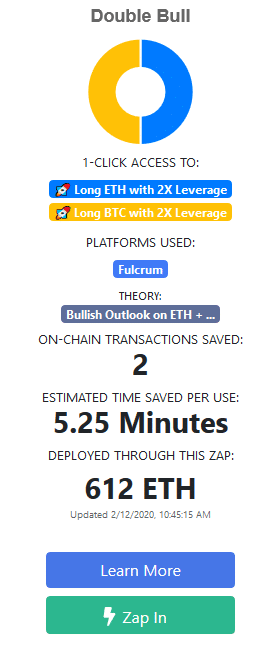

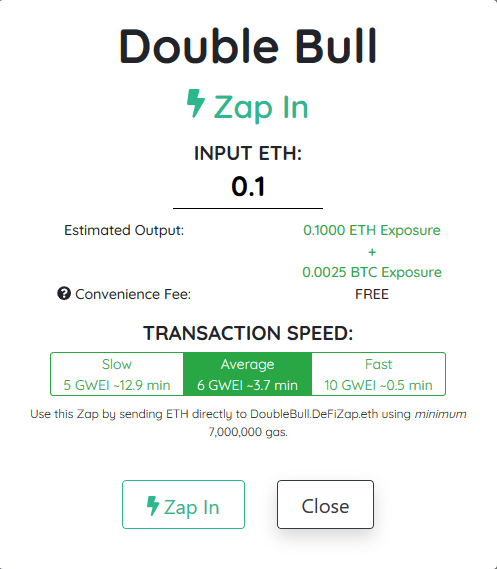

For example, in case the user is positive about the price of Ethereum and Bitcoin, they can use the Zap “Double Bull”, which will invest in ETH and WBTC using a 2x leverage on Fulcrum (WBTC is the ERC20 token representative of Bitcoin, whose Bitcoin peg is guaranteed by BitGo).

The function is active starting from Ether and with only 1 click, saving time and money in terms of gas for example.

Each Zap also has an ENS address to which it is possible to directly send Ether, together with the recommended Gas, to start the contract on the platforms indicated in the recipe, making it even more practical to use. For example, the Zap “Double Bull” can be used by sending ETH to the address DoubleBull.DeFiZap.eth .

The latest feature introduced is the ZAPOUT functionality, which allows liquidating ZAP with a single click, without having to go through the platforms used by the recipe. The team is also open to suggestions for new Zaps, through a form where new recipes can be suggested (even if at the time of writing the article it doesn’t seem to work).

Is all that glitters gold?

For DeFiZap fans, it is an extremely convenient and cheap way to invest. At the same time, however, it should not be forgotten that the protocols it works on, which in themselves are advanced financial instruments, are based on smart contracts with cryptocurrencies as the underlying assets.

The code with which smart contracts are written is often verified by several security audits, but it is the human factor that remains the source of risk. Using multiple protocols at the same time increases the risk, and as the value locked in DeFi goes up (we are at $1.1 billion), so does the interest of potential hackers in breaking the code. These tools are also based on highly volatile digital assets, cryptocurrencies.

Although DeFi’s dApps often clearly indicate that they are alpha or beta versions, more should be done to alert users of the risks they face. Reducing the number of clicks decreases the awareness required by the user, who attracted by easy earnings in a bull market moment could choose a recipe that liquidates the capital at the first Ethereum retracement.

All it would take is a disclaimer every time the user tries to connect MetaMask to the dApp. Usability is also this, and hopefully, the developers will become aware of it – or is there a need for a black swan event to wake up the community?